Accelerating the Sector’s Digital Transformation

with the Accountancy Industry Digital Plan (IDP)

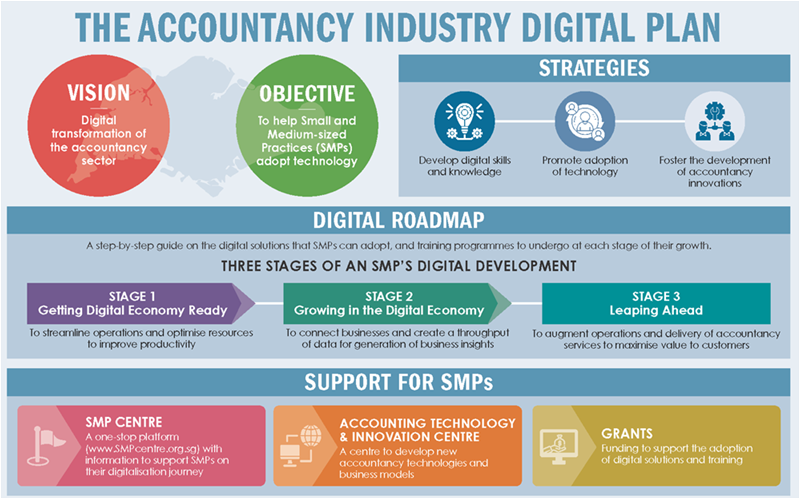

The Accountancy IDP is a roadmap that guides and supports SMPs on their digitalisation journey.

It focuses on three strategies: enhancing digital skills and knowledge, promoting the adoption of technology, and developing accounting technology and innovations.

The IDP comprises a Digital Roadmap that guides SMPs on the digital solutions to adopt and the employee training to undertake at each stage of their digital development.

SMPs can visit the SMP Centre, a one-stop portal that provides information to support their digital development. For SMPs that are keen to develop new accountancy technologies and business models, the Accounting Technology & Innovation Centre is a valuable resource.

The Accountancy IDP was jointly developed in August 2019 by the Singapore Accountancy Commission, the Institute of Singapore Chartered Accountants (ISCA) and the Infocomm Media Development Authority (IMDA). It is part of IMDA’s SMEs Go Digital programme, which aims to simplify the process of digital adoption for SMPs.