Here are some useful information to guide you in using the BizFinx preparation tool more smoothly.

Importing prior year’s information

There are three methods to prepare XBRL financial statements for a subsequent year:

- Open file with prior year’s XBRL financial statements and click on ‘Load Prior Period Data’ (recommended method)

Under this method, the prior year column in the templates will be filled with the data corresponding to the elements against which a match is found.

- Create a new XBRL financial statement file with subsequent year data, and import prior year data from prior year XBRL financial statements

Note that any imported data that does not match any data element in the templates will not be populated in the prior year column.

- Open file with prior year’s XBRL financial statements, and change dates accordingly for current year preparation

Under this method, there is a risk of certain data elements (e.g. text block) not being updated and erroneously filed as subsequent year filing.

Use the auto-tagging function

You can use the “auto-tagging” function to populate the latest data for all previously-tagged elements in statement of financial position, income statement and statement of cash flow. However, auto-tagging will not work on common elements in the XBRL financial statements (e.g. trade and other receivables under both current and non-current categories, in statement of financial position).

Refer to company label

Upon loading of prior year’s data, company labels (including combined company labels that are defined element names separated by “│”) created in prior year are ported over for your easy reference.

Check the footnotes

Please check that the footnotes are still relevant and accurate before submitting.

Complete Income Statement template

In this section, the financial statements (FS) tabled at AGM and/or sent to members will be referred to as the AGM FS.

How to complete the template efficiently:

- The XBRL income statement template collects information by “nature of expense” as the presentation of key expenses by nature will always be available, either in the income statement or in the note. Companies which present their income statement using the “function of expense” format must still disclose their key expenses by nature in the notes to the financial statements, as required under the Accounting Standards.

- You may check the notes in the AGM FS and map to the breakdown of expenses required in Income Statement XBRL template, based on best-fit principle

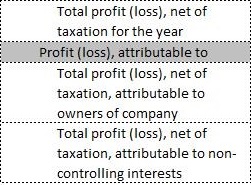

- Complete the fields under "Profit (loss), attributable to" in income statement XBRL template.

-

Companies are required to present how the profit or loss for the period is attributed, under FRS 1 Presentation of Financial Statements paragraph 81B(a). If there is no disclosure in the AGM FS, please check with company's accountant to see if the full amount of total profit (loss) should be attributed to owners of the company.

Calculation for ease of reference

“Total profit (loss), net of taxation for the year”

= “Total profit (loss), net of taxation, attributable to owners of company”

+ “Total profit (loss), net of taxation, attributable to non-controlling interests”.

Complete Statement of Financial Position template

1. How to complete the template efficiently:

- Open a copy of the financial statements (FS) tabled at AGM and/or sent to members (AGM FS) in word / excel format as source document through the toolbox, as shown in this video.

- Check that the template format is similar to the AGM FS, such as the current/prior financial year start and end dates and number of columns should match.

- To add/edit/delete a third column (e.g. for beginning of preceding period due to restatements), use the “custom date options” function in toolbox.

- To add/delete columns on "Company" in consolidated FS, use the “company” function in toolbox.

- To add/edit/delete a third column (e.g. for beginning of preceding period due to restatements), use the “custom date options” function in toolbox.

- Automatically populate the template from the AGM FS, by using the auto-tag function as shown in this video.

- Drag-and-drop the financial data on the source document to the template by rows (single row / multiple rows with function to aggregate / overwrite the values), instead of manually keying in the figures as shown in this video.

Complete Note - Property, plant and equipment and Note - Intangible Assets templates

1. How to complete the template efficiently (the same tip applies for Intangible Assets):

- Compare the different classes of property, plant and equipment (PPE) in the template to the AGM FS. Ensure that the columns on the classes of PPE matches between the template and AGM FS.

- For the template, click to “edit classes of property, plant and equipment” to select and re-order the classes of PPE.

- For the AGM FS (if the classes of PPE in AGM FS is different from the classes of PPE in the template), you may want to copy the table in note – PPE in AGM FS to excel and make the necessary adjustments (i.e. adjusted table) to ensure that the classes of PPE match to the template. For example, if the AGM FS has disclosed “freehold land” and “leasehold buildings” separately, please combine as one column to be disclosed as “freehold land and leasehold buildings” in the adjusted table to be mapped to “land and building” in the template.

- Open the adjusted table as source document through the toolbox, as shown in this video.

- Drag-and-drop the financial data on the source document to the template by rows (single row / multiple rows with function to aggregate / overwrite the values) as shown in this video.

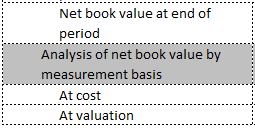

2. How to resolve genuine errors misc_040 or misc_102:

If you encounter genuine errors Misc_040 or Misc_102, please complete either or both “At cost” and “At valuation” fields under "Analysis of net book value by measurement basis” element. Please ensure the sum of the values of “At cost” and “At valuation” is equal to the value of “Net book value at end of period” disclosed in the same template.

Calculation for ease of reference

“Net book value at end of period”

= “At cost”

+ “At valuation”

3. Right-of-use assets for (a) Note - Property, plant and equipment and (b) Note - Intangible assets

Similarly, please include any right-of-use assets accounted for as Intangible assets within the (a) “Intangible assets (excluding goodwill), non-current” balance in “Statement of Financial Position” template and (b) the movements of Intangible assets in “Note – Intangible Assets” template.

Quick guide of preparation tool

View the Quick Guide for BizFinx Preparation Tool v3 (PDF, 1.83MB). (Last updated in August 2021)