|

|

|

| JAN / FEB 2024 |

|

|

|

|

|

|

|

acra.gov.sg |

| Lower fees and enhanced support for the Singapore Chartered Accountant Qualification |

|

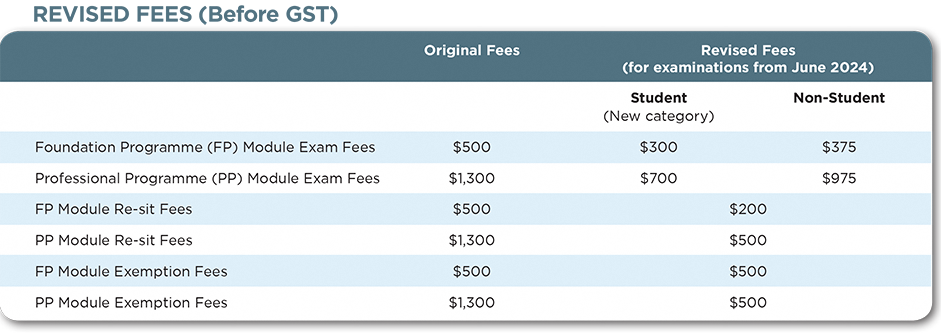

From June 2024, examination fees for the Singapore Chartered Accountant Qualification (SCAQ) will be reduced to encourage more individuals to pursue the qualification. Re-sits, and exemptions fees for both the Foundation Programme and Professional Programme will also be reduced. Furthermore, a new category of examination fees will be introduced to encourage students to pursue SCAQ while studying in the Institutes of Higher Learning.

ACRA Chief Executive, Mr Ong Khiaw Hong said, “The fee revision will make the SCAQ accessible to a wider pool of talent to help build a sustainable talent pipeline for accountancy professionals in Singapore.”

The SCAQ is the national Chartered Accountant qualification. The programme is globally recognised, and designed to cultivate leaders in the field of accountancy. Since 1 January 2024, the Institute of Singapore Chartered Accountants (ISCA) has been administering SCAQ on behalf of ACRA.

If you are interested in taking the June 2024 examinations, apply anytime from 15 January to 31 March 2024.

|

|

| Advancing Sustainability Disclosures, Compliance, and the Combat against Illicit Financial Activities |

|

At the Audit and Risk Committee Seminar 2024, ACRA’s Chief Executive, Mr Ong Khiaw Hong, spoke about the importance of leadership in advancing sustainability disclosures, strengthening voluntary compliance, and combating illicit financial activities. He emphasised the need to foster sustainable and ethical practices to create a more responsible, resilient, and equitable society for current and future generations.

Ms Tan Wee Khim, ACRA’s Technical Director of the Financial Reporting & Standards Department, shared common findings gleaned from a decade of ACRA’s Financial Reporting Surveillance Programme (FRSP). She also highlighted some preliminary insights from an ongoing study on climate-related disclosures, conducted in collaboration with the NUS Sustainable and Green Finance Institute.

More than 300 audit committee members and directors of listed companies attended the seminar on 10 January, organised by ACRA, the Singapore Exchange Regulation (SGX RegCo) and the Singapore Institute of Directors (SID).

|

|

| Encouraging timely filing of Annual Returns and Annual Declarations |

|

ACRA is sending email reminders to office holders to prompt them to submit their Annual Returns and Annual Declarations punctually. Late filing penalties can come up to $600.

To benefit from this service, update your email address on BizFile+.

|

|

|

| Combatting Illicit Activities: ACRA cancels registrations of filing agent and qualified individual |

|

On 18 January 2024, ACRA cancelled the registrations of filing agent, LW Business Consultancy Pte Ltd and qualified individual, Wang Junjie due to breaches of anti-money laundering and countering the financing of terrorism (AML/CFT) controls under the ACRA (Filing Agents and Qualified Individuals) Regulations 2015.

Registered Filing Agents (RFAs) and Registered Qualified Individuals (RQIs) provide corporate secretarial services for business entities, including assisting customers with company incorporation, filing annual returns, and meeting other filing requirements under the Companies Act 1967 and other Acts under ACRA’s purview. They are required to conduct customer due diligence in line with ACRA Regulations, and operate in a manner that prevents money laundering and the financing of terrorism. As such, they play a crucial role in identifying and combating illicit activities.

ACRA takes a serious view of AML/CFT regulation breaches and is committed to taking decisive enforcement action against non-compliant service providers. RQIs and RFAs who fail to fulfil their statutory obligations may face enforcement actions, such as financial penalties of up to $10,000 or $25,000 per breach, and have their registrations with ACRA suspended or cancelled.

Anyone with reason to believe that an RQI or RFA has potentially breached their statutory obligations should promptly report the matter to ACRA.

|

|

|

|

ACRA's

e-Newsletter for professional stakeholders

This e-newsletter is intended for general information only and should not be treated as a substitute for specific professional

advice for any particular situation. While we endeavour to ensure the contents are correct to the best of our knowledge and

belief at the time of writing, we do not warrant their accuracy or completeness nor accept any responsibility for any loss or

damage arising from any reliance on them.

Copyright © 2024 Accounting and Corporate Regulatory Authority. All Rights Reserved.

SUBSCRIBE | www.acra.gov.sg | www.acra.gov.sg |

|

|