|

|

|

| SEP / OCT 2023 |

|

|

|

|

|

|

|

acra.gov.sg |

ACRA releases the Annual Report FY2022/23, themed,

'Enabling Businesses, Fostering a Trusted Environment' |

ACRA's annual report for FY2022/23 provides insights

into the organisation's strategy and future plans to

create a dynamic and trusted business environment

that fosters innovation and growth.

One of the key highlights of the report is ACRA's

transformation from being an information provider to

a business enabler that delivers value to businesses,

and fosters a well-regulated and trusted business

environment. We are achieving this transformation

through the strategic use of technology, data-driven

decision-making, and a more customer-centric approach. |

|

The report also covers how ACRA has strengthened regulations to ensure that Singapore's

corporate regulatory regime is robust, resilient against money laundering and terrorism financing,

and supports our growth as a global hub for businesses and investors.

In addition, ACRA has embarked on advancing Sustainability Reporting (SR) to support Singapore's

transition to a green economy. Reliable SR is essential for a more sustainable future, and ACRA is

committed to playing a key role in this area.

We invite you to find out more about ACRA's initiatives.

|

|

| Unlock business value with the new Intangibles Disclosure Framework |

|

Intangible Assets (IA), such as brand value, patents or

registered designs, can significantly increase the value

of a business, making it more attractive to potential

investors. For instance, a strong brand can help a

company to attract more customers. This highlights

the importance of understanding the value of IA for

a business' financial health. However, IA can be

challenging to value accurately.

To address this, ACRA and the Intellectual Property

Office of Singapore (IPOS) introduced the Intangibles

Disclosure Framework (IDF). It was launched at

the IP Week @ SG 2023 on 4 September 2023 by

Second Minister for Finance, Ms Indranee Rajah. |

The IDF is among the first in the world that provides a systematic and consistent way to disclose

and communicate IA. It comprises four pillars to guide businesses on IA disclosure: strategy,

identification, measurement, and management. Improved IA disclosures can lead to better

investment decisions, improved risk management, and increased competitiveness, allowing

businesses to maximise their economic potential.

The IDF is part of the Singapore IP Strategy 2030 which aims to develop Singapore into a global

hub for Intangible Assets and Intellectual Property.

|

|

ASEAN Audit Regulators Group and the Financial Statements

Surveillance Group held combined workshop |

In September this year, the ASEAN Audit Regulators

Group (AARG) and Financial Statements Surveillance

Group (FSSG) came together for a combined workshop,

hosted by ACRA. As collaboration amongst audit and

financial reporting regulators can improve audit and

financial reporting quality, the combined AARG and

FSSG workshop was held to generate more discussion

and sharing of ideas.

In his welcome address, Mr Ong Khiaw Hong, Chief

Executive, ACRA, highlighted how technology can

help regulators to ensure compliance with accounting

and auditing standards, promote good corporate

governance, and protect the interests of investors |

|

and other stakeholders. He said, "The use of advanced technology such as machine learning and

artificial intelligence has enabled us to better monitor and detect the risks of non-compliance in our

regulatory work, taking on a more proactive role, instead of employing only reactive methods in our

existing process."

With the rising importance of climate change and its impact, we invited a speaker to share about sustainability reporting and its related financial reporting implications.

More than 70 delegates from AARG and FSSG member countries including Singapore, Indonesia,

Malaysia, Philippines, Thailand, as well as guest countries, Cambodia and Hong Kong, attended

this workshop. |

|

Raising global recognition of the Singapore Chartered

Accountant Qualification: ISCA and CPA Australia sign Mutual

Recognition Agreement |

|

In today's globalised economy, businesses frequently

transfer their senior finance and accounting staff

members to helm key positions across regions.

Mutual Recognition Agreements (MRAs) between

countries allow accountants to have their qualifications

recognised in other countries. They facilitate the

movement of talent across borders, promote

consistency in the quality of the accounting profession,

and reduce the costs of obtaining new qualifications.

In September this year, the Institute of Singapore

Chartered Accountants (ISCA) and CPA Australia

signed an MRA, allowing ISCA members to be

members of CPA Australia, and vice versa. |

The

agreement was reached after ISCA, CPA Australia and ACRA assessed the equivalence between

the Singapore Chartered Accountant (CA) Qualification and the CPA Program, as well as

membership requirements of ISCA and CPA Australia.

To date, the Singapore CA Qualification is mutually recognised with CA programmes offered by worldrenowned

professional bodies in Australia, England, Ireland, New Zealand, Scotland and Wales.

|

|

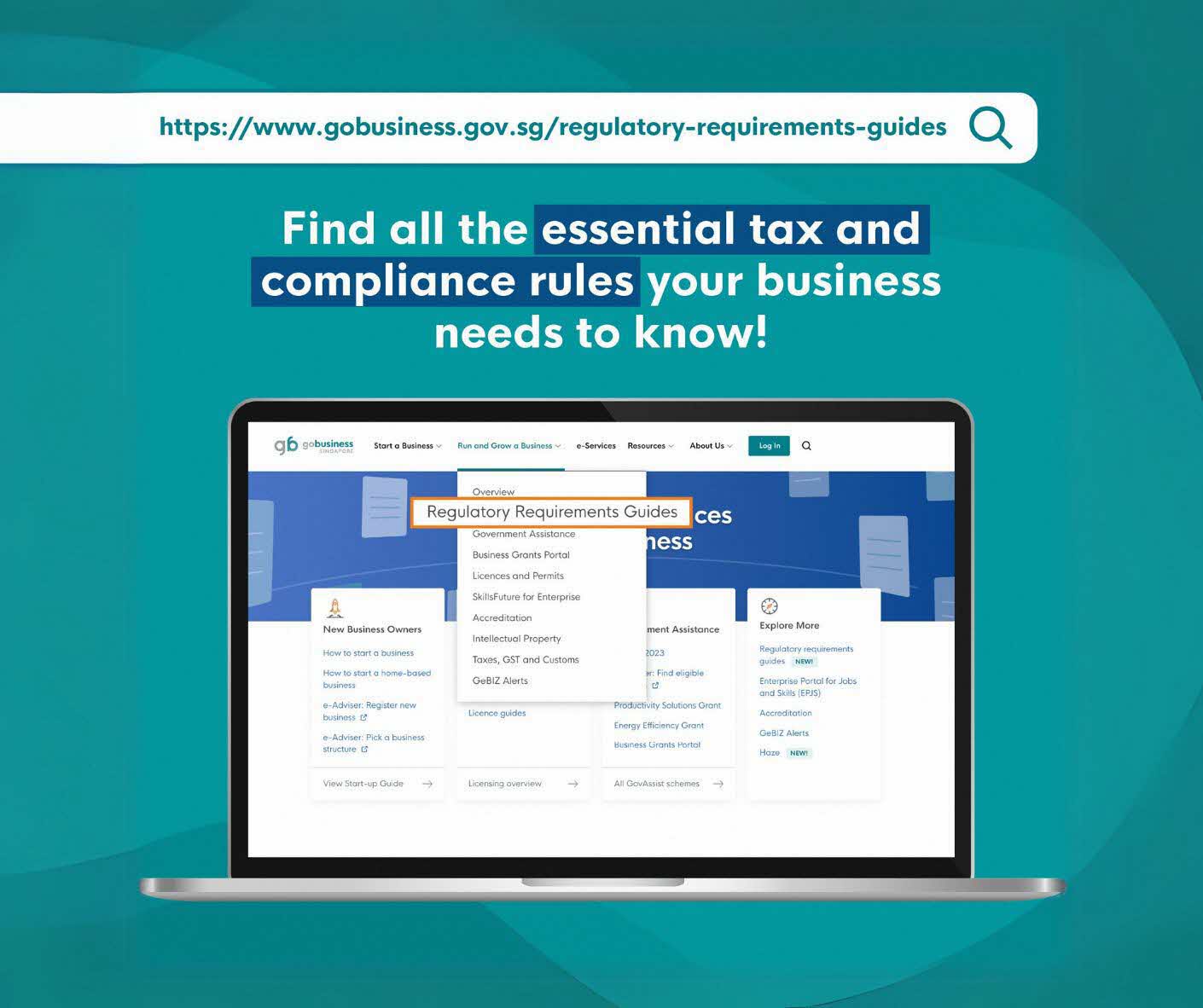

Navigate tax and compliance rules with ease: GoBusiness

launches Regulatory Requirements Guides |

|

Staying abreast of regulations can be challenging

while growing a profitable business. Fortunately,

the GoBusiness website now offers the Regulatory

Requirements Guides to help businesses in Singapore

to easily navigate tax and compliance rules.

The guides provide clear steps to comply with

regulations from ACRA, the Ministry of Manpower

(MOM), the Central Provident Fund Board (CPF) and

the Inland Revenue Authority of Singapore (IRAS).

Ensure your business stays on the right side of the law

by keeping updated with the latest regulations at the

following link:

|

|

|

|

ACRA's

e-Newsletter for professional stakeholders

This e-newsletter is intended for general information only and should not be treated as a substitute for specific professional

advice for any particular situation. While we endeavour to ensure the contents are correct to the best of our knowledge and

belief at the time of writing, we do not warrant their accuracy or completeness nor accept any responsibility for any loss or

damage arising from any reliance on them.

Copyright © 2023 Accounting and Corporate Regulatory Authority. All Rights Reserved.

SUBSCRIBE | www.acra.gov.sg | www.acra.gov.sg |

|

|