Background

The Accountancy Workforce Review Committee (AWRC) was set up in October 2022, with the support of the Ministry of Finance and the Accounting and Corporate Regulatory Authority, to address the manpower challenges of the accountancy sector and recommend strategies to ensure a robust pool of accountancy talents to meet industry needs.

Summary of AWRC recommendations

Download the Accountancy Workforce Review Committee Report (PDF, 3.72MB).

Key Recommendations

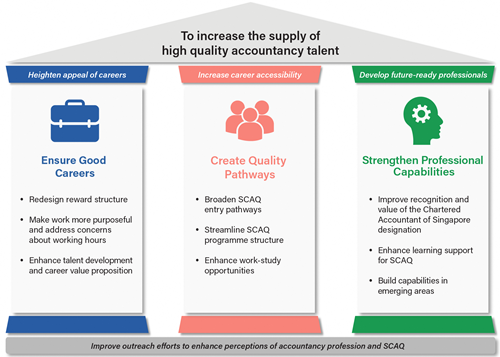

The AWRC’s recommendations span three key pillars:

Ensure Good Careers, by heightening the appeal of an accountancy career and positioning accountancy as a profession of choice. Employers should revisit the value proposition that they offer their employee accountants and adjust as needed to meet their changing aspirations and meet their desire for purposeful work.

-

Redesign reward structure.

-

Announcements by Accounting Entities on the adjustments to starting salaries.

Create Quality Pathways, by increasing the accessibility of an accountancy career to talent from diverse sources. ACRA will work with the Institute of Singapore Chartered Accountants (ISCA) to make the Singapore Chartered Accountant Qualification (SCAQ) more streamlined and accessible to candidates of different backgrounds, while universities should work with employers to expand work-study opportunities, which will improve the work-readiness of students and facilitate their entry into the accountancy profession.

- Work-study opportunities:

- Launch of the new WSDeg by Nanyang Technological University (Bachelor of Accountancy (Sustainability Management and Analytics).

- A programme to support non-accountancy graduates develop core accounting competencies by Ngee Ann Polytechnic (Accountancy Careers Launchpad).

- ACRA will explore partnering institutes of higher learning to provide more structured training and employment opportunities, with possible integration with the SCAQ.

- Pathways for non-accountancy students:

- ACRA will work with universities to develop and introduce accountancy minors and double degrees (with accountancy), to expose more students to basic accounting and possible career options in the accounting sector.

- Enhancements to SCAQ:

- Accountancy polytechnic graduates are no longer required to pursue the Advanced Diploma in order to enrol in the SCAQ.

- Non-Accountancy polytechnic graduates such as Business Management, or even Engineering, will be able to enrol in the SCAQ.

- Streamlining SCAQ:

- Polytechnic accountancy graduates will be exempted from the Principles of Financial Reporting module and/or Taxation module of the SCAQ Foundation Programme if they had completed the equivalent module during their studies.

- Recognition of up to 18 months of prior practical experience in the fulfilment of the 3 years of relevant practical experience.

- ACRA will continue to study the possibility of granting exemptions for the SCAQ’s modules to reduce the length of time required for candidates to complete the SCAQ, if candidates have fulfilled the necessary prerequisites.

Strengthen Professional Capabilities, to develop future-ready professionals to navigate changes and seize opportunities. ACRA will work with the relevant regulators and ISCA to enhance the recognition of the Chartered Accountant (Singapore) designation and the learning support provided for the SCAQ, while ensuring that the relevant curriculum equips accountants with capabilities in emerging areas.

- Improve recognition of CA (Singapore):

- There is a need to emphasise to listed companies to employ accountants with professional qualifications from reputable accountancy bodies, such as the Singapore Chartered Accountancy qualification in their key finance functions. SGX RegCo is studying the issue in line with the AWRC's recommendation.

Resources

- NTU Accountancy for Future Leaders - Bachelor of Accountancy (Sustainability Management and Analytics)

- Singapore Chartered Accountant of Singapore (SCAQ)

- Online and print media coverage on the AWRC Report publication by ST, BT, BH, ZB and 8World Online, as well as broadcast media coverage by Channel 8 and CNA.

- Online and print media coverage by ST, BT, ZB, 8World Online

- Coverage by The Edge (Deloitte & KPMG), on stakeholders’ initiatives, e.g. raising starting salary of accounting graduates.

- ST publication of a commentary by Evan Law, Assistant Chief Executive, ACRA.